Our Business consultive Services cluster helps organizations anticipate shifts within the marketplace and refine their methods to adapt to dynamic conditions. we have a tendency to area unit consultants in orienting strategy, processes and folks to attain specific, measurable outcomes. we have a tendency to facilitate shoppers perceive United Nations agency their most profitable customers area unit and why. Then we have a tendency to teach them a way to win client loyalty within the face of intense competitive and value pressures. we have a tendency to follow a similar disciplined approach once assessing competitors and market opportunities.

We have developed sturdy tools and ways to assist our shoppers develop

and execute winning strategic priorities. Our Strategic consultive

Services include:

Business Strategy & Growth designing

We facilitate organizations address business designing by developing workable methods with specific, measurable goals and objectives. victimization our ALIGN it Strategy Framework, we have a tendency to facilitate firms answer basic queries in a very structured and action homeward-bound approach. This approach helps organizations:

We facilitate organizations address business designing by developing workable methods with specific, measurable goals and objectives. victimization our ALIGN it Strategy Framework, we have a tendency to facilitate firms answer basic queries in a very structured and action homeward-bound approach. This approach helps organizations:- Challenge alignment of vision, strategy and business processes

- value and grade price drivers and price detractors

- Align the organization around a standard set of goal and objectives

If your organization is scuffling with your strategy, our Business consultive Services cluster will facilitate.

Customer Analysis & marketing research

Knowledge is power. a radical understanding of your customers is preponderant to long success. we have a tendency to facilitate organizations perceive United Nations agency their best customers area unit and why. Applying well-tried marketing research tools and ways unlocks vital insights into your success formula. Our client identification & Analysis Methodology provides a well-tried path to gleaning recent insights and disabling perceptions. investing this approach, shoppers can:

Knowledge is power. a radical understanding of your customers is preponderant to long success. we have a tendency to facilitate organizations perceive United Nations agency their best customers area unit and why. Applying well-tried marketing research tools and ways unlocks vital insights into your success formula. Our client identification & Analysis Methodology provides a well-tried path to gleaning recent insights and disabling perceptions. investing this approach, shoppers can:- section shoppers and prospects supported common attributes

- Tune the consumer portfolio and programs to maximise business price

- Develop methods to retain and grow high price segments

- determine and target programs to capture the correct customers

If your organization is probing for recent insight to assist grow your business, our Business consultive Services cluster will facilitate.

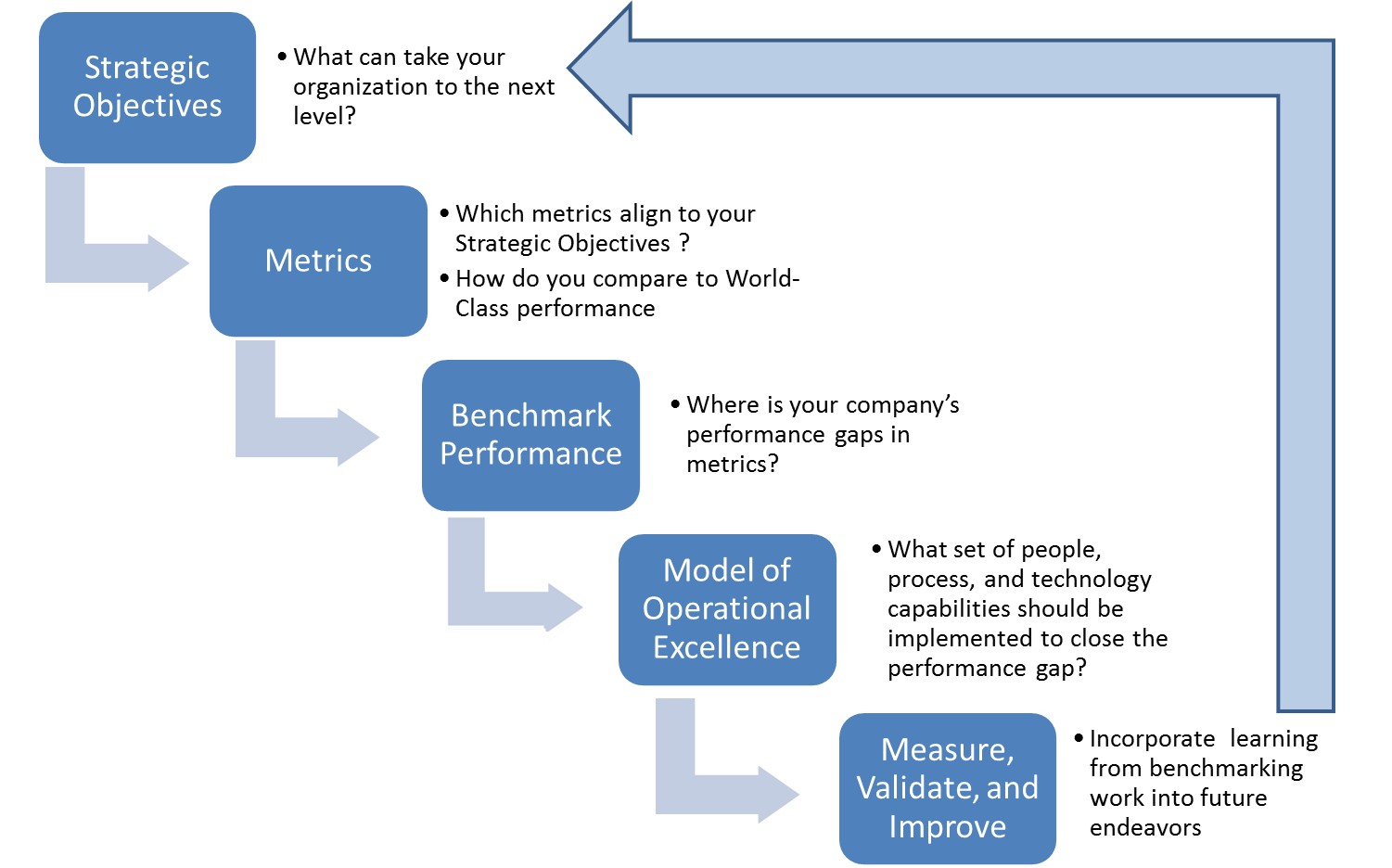

Competitive & business Benchmarking

Competition may be a market reality. Understanding individual performance relative to business peers provides required perspective to upset it. It drives required leadership dialogue and helps focus enhancements to seize market opportunities. Our team works with organizations to assist assess monetary and operational performance. Our InSIGHT price analysis and framework, provides a well-tried approach to pairing business knowledge and business performance. Our toolset allows our team to quickly unlock insights, align to price levers and introduce performance enhancing methods.

We collaborate with leaders to qualify the market opportunities. we have a tendency to use benchmarks to assist our shoppers perceive their strengths and weaknesses. Then we have a tendency to develop methods to take advantage of the strengths and address the deficiencies. Our breadth of purposeful and business expertise allows our team to assist organizations develop best at school performance. If you wish a replacement perspective on your business, we will facilitate.

Sales & Relationship Management Support

Complex sales need focus and discipline. Understanding stakeholders and organizing resources give the sting to beat your competition. Our older team provides a set of tools and ways to programmatically determine, target and develop strategic accounts. we have a tendency to facilitate deploy well-tried management techniques to stay relevant and front of mind. victimization our pragmatic approach to assembling trust, understanding distinctive consumer needs and enhancing your price proposition to shut the sale is prime to our thinking.

If you're seeking a partner to assist you improve your account management practices, we will facilitate.

Financial Strategy & Capital designing

Capital may be a precious resource. Understanding a way to effectively deploy it are often the distinction between success and failure. Our team of advisors helps bring monetary rigor to the present crucial call. we have a tendency to leverage our finance, accounting and tax expertise to know and maximize potential results with restricted capital resources. Our advisors area unit adept at making careful monetary models parenthetically the execs and cons of assorted strategic selections. we have a tendency to work with leadership to judge every situation and so develop a monetary strategy and capital structure to satisfy the requirements of business and its stakeholders. As needed, we will faucet our network to produce sources of capital.

If you're seeking associate degree objective perspective to assist along with your monetary strategy, we will facilitate.

IT Strategy & designing

Effective data Technology (IT) solutions ought to function a catalyst for growth. Our team believes IT designing ought to begin with a rigorous analysis of business desires and objectives. Too often, technology selections lead the business. we have a tendency to believe this approach typically ends up in dilution of the business strategy and distracts precious resources.

Our PlanIT methodology provides a well-tried path to drive IT selections that area unit unmoving in business priorities. Our consultants begin with shaping crucial business methodes and so developing careful needs to drive associate degree objective technology choice process. we have a tendency to facilitate the business build a case for amendment and sometimes assist with the execution to confirm edges area unit realised. choosing {a solution|an associate degreeswer} and an acceptable IT partner may be a call that ought to not be taken gently. If you would like facilitate in shaping your business has to higher drive associate degree hip technology call, we will facilitate.